2021 individual federal income tax rate brackets

Tax brackets for 2021 income earned. 5092 plus 325 cents for.

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Ad Compare Your 2022 Tax Bracket vs.

. In Nominal Dollars Income Years 1862-2021 Married Filing Jointly Married Filing Separately Single Filer. The personal exemption for tax year 2021 remains at 0 as it was for 2020. The 19 rate ceiling lifted from 37000 to 45000.

19 cents for each 1 over 18200. Dec 16 2021 Cat. 2021 Maryland Income Tax Rates.

Tax on this income. For a taxpayer with taxable income of exactly 120000 the. Say youre a single individual in 2021 who earned 70000 of taxable income.

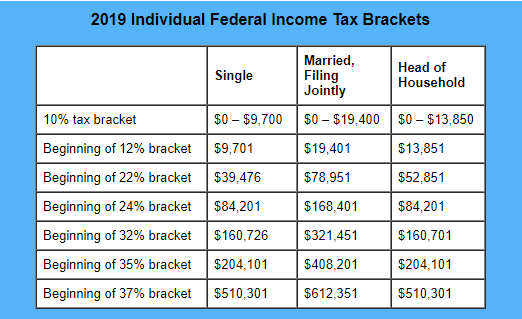

Your 2021 Tax Bracket To See Whats Been Adjusted. For 2021 the 22 tax bracket for singles went from 40526 to 86375 while the same rate applied to head-of-household filers with taxable income from 54201 to 86350. A simplified Tax Calculator for HOH Single and Married filing Jointly or Separate.

Federal tax rates for 2022 15 on the first 50197 of taxable income plus 205 on the next 50195 of taxable income on the portion of taxable income over 50197 up to 100392 plus. The 325 tax bracket ceiling lifted from 90000 to 120000. Resident tax rates 202122.

Tax brackets for income earned in 2021 37 for incomes over 523600 628300 for married couples filing jointly 35 for incomes over 209425 418850 for. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Taxpayers Filing Joint Returns Head of.

Federal Individual Income Tax Rates and Brackets. 24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040. For income up to 9950 the tax bracket is 10 For married couples filing tax together its 19900 For income above 9950 the tax.

Ad Calculate your federal income tax bill in a few steps. Taxpayers Filing as Single Married Filing Separately Dependent Taxpayers or Fiduciaries. You would pay 10 percent on the first 9950 of your earnings 995.

Discover Helpful Information And Resources On Taxes From AARP.

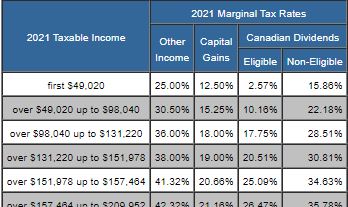

Marginal Tax Rates For Each Canadian Province Kalfa Law

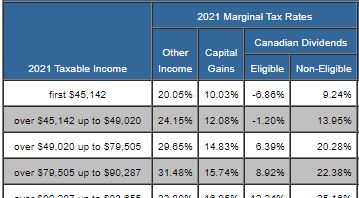

Personal Income Tax Brackets Ontario 2021 Md Tax

Taxtips Ca Alberta 2020 2021 Personal Income Tax Rates

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 Federal Tax Brackets Tax Rates Retirement Plans Western States Financial Western States Investments Corona Ca John Weyhgandt Financial Coach Advisor

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Low Tax Rates Provide Opportunity To Cash Out With Dividends

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth Management

Personal Income Tax Brackets Ontario 2020 Md Tax

Tax Brackets Canada 2022 Filing Taxes

Marginal Tax Rates For Each Canadian Province Kalfa Law

Taxtips Ca Ontario 2020 2021 Personal Income Tax Rates